Analyzing the U.S. Economic Outlook: Rising Consumer Spending Amid Controlled Inflation

Inflation Trends Amid Growing Consumer Expenditures

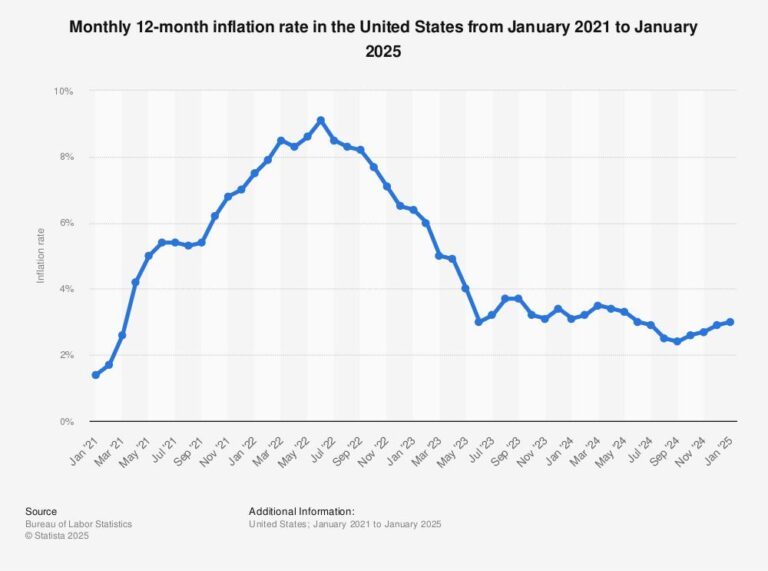

Recent statistics from the U.S. Commerce Department paint a complex picture of the economy, where consumer spending is steadily increasing without a corresponding surge in inflation. Despite Americans allocating more funds toward goods and services, the inflation rate has moderated compared to earlier periods. Analysts attribute this phenomenon to improvements in supply chain logistics and stabilized energy costs, which have collectively eased inflationary pressures even as demand remains strong.

Several critical elements shaping this dynamic include:

- Price stabilization in key commodities such as fuel and food products

- Heightened consumer optimism fueling retail and service sector growth

- Alleviation of supply bottlenecks enhancing product availability

- Federal Reserve’s calibrated monetary policies balancing economic expansion with inflation control

| Month | Change in Consumer Spending (%) | Inflation Rate (%) |

|---|---|---|

| March | 1.2% | 4.5% |

| April | 1.5% | 4.3% |

| May | 1.6% | 4.1% |

Economic Resilience Evident in Commerce Department’s Latest Figures

The newest Commerce Department data highlights a resilient U.S. economy, characterized by a steady climb in consumer spending alongside manageable inflation rates. Despite ongoing concerns about rising prices, inflation remains contained, supporting continued household consumption. This delicate equilibrium suggests that current economic policies are effectively fostering stability, bolstering confidence among consumers and investors alike.

Noteworthy observations include:

- Consistent growth in consumer outlays across retail, services, and durable goods sectors.

- Inflation rates remaining moderate, defying earlier forecasts of sharper increases.

- Robust performance in core industries such as housing and automotive sales, which continue to expand.

| Indicator | Previous Month | Current Month | Difference |

|---|---|---|---|

| Consumer Spending | +0.3% | +0.5% | +0.2% |

| Inflation Rate | 3.7% | 3.5% | -0.2% |

| Retail Sales | +0.4% | +0.6% | +0.2% |

Understanding the Drivers Behind Controlled Price Increases

Economic experts attribute the steady but moderate rise in prices to a blend of recovering supply chains and sustained consumer demand. After a period marked by volatility, industries are normalizing production schedules, while consumers continue to spend actively, creating a balanced environment where inflation grows gradually rather than explosively. Key sectors such as housing and energy have maintained consistent price growth, reinforcing this trend.

- Supply Chain Improvements: Enhanced logistics and fewer disruptions have reduced panic-induced price spikes.

- Consumer Demand: Rising incomes and delayed spending from previous periods continue to drive retail and service purchases.

- Labor Market Conditions: Wage growth supports purchasing power but has not yet triggered significant inflationary spirals.

| Sector | Price Growth Rate (%) | Primary Influence |

|---|---|---|

| Housing | 3.1 | Strong Demand |

| Energy | 2.4 | Stable Supply |

| Food & Beverages | 1.8 | Moderate Demand |

| Transportation | 2.0 | Fuel Price Stability |

Nevertheless, economists caution that persistent inflationary pressures require vigilant policy oversight. External factors such as geopolitical tensions and fluctuating commodity markets could introduce volatility. Additionally, monitoring wage trends and consumer spending habits remains essential to prevent inflation from accelerating beyond manageable levels.

Strategic Policy Approaches to Maintain Inflation Stability Amid Rising Spending

To sustain the current balance between rising consumer spending and controlled inflation, policymakers should adopt a multifaceted strategy emphasizing fiscal prudence and targeted investments. Prioritizing infrastructure projects and technological advancements can stimulate economic growth without exacerbating inflation. Transparent communication of monetary policy will also be vital to anchor inflation expectations and maintain confidence among consumers and businesses.

Recommended policy actions include:

- Strengthening supply chain networks to minimize bottlenecks that contribute to cost-push inflation.

- Deploying targeted subsidies for essential commodities to alleviate price pressures without distorting market dynamics.

- Promoting wage moderation in sectors with rapid compensation growth to avoid wage-price inflation spirals.

| Policy Initiative | Anticipated Outcome | Implementation Timeline |

|---|---|---|

| Diversification of Supply Chains | Reduced price volatility | 1-2 Years |

| Targeted Subsidies | Lower consumer expenses | Immediate |

| Clear Monetary Policy Communication | Anchored inflation expectations | Ongoing |

Summary: Navigating Economic Stability in a Changing Landscape

The latest Commerce Department data underscores a promising economic scenario where consumer spending is on an upward trajectory while inflation remains contained. This balance offers a hopeful outlook for sustained economic growth amid global uncertainties. Moving forward, continuous monitoring of these trends will be crucial to ensure that this equilibrium endures, supporting both consumer confidence and market stability.