Rethinking Labor Market Flexibility to Meet Inflation Goals

Federal Reserve Governor Christopher Waller recently indicated that the U.S. labor market might need to loosen further to help the central bank reach its 2% inflation objective, as reported by Reuters. His remarks come amid ongoing discussions about the appropriate speed of monetary tightening, given that inflation remains stubbornly high. Waller’s viewpoint suggests that increasing labor market slack—essentially allowing for a bit more unemployment or underutilized workforce capacity—could be essential for sustainably lowering inflation, hinting at a more measured stance in upcoming interest rate decisions.

Labor Market Dynamics and Inflation Pressures: Insights from Kansas City Fed

Esther George, President of the Federal Reserve Bank of Kansas City, has underscored the necessity of greater labor market flexibility amid persistent inflationary challenges. She argues that the U.S. economy may require a higher unemployment rate or increased slack to moderate wage growth, which in turn could help ease inflationary pressures. This perspective reflects a cautious approach to monetary policy, recognizing that the labor market remains exceptionally tight and that reaching the Fed’s 2% inflation target might take longer than initially expected.

Several key factors shape this outlook:

- Strong wage growth: Elevated wage increases risk fueling further inflation if not contained.

- Supply chain bottlenecks: Persistent disruptions continue to push prices upward.

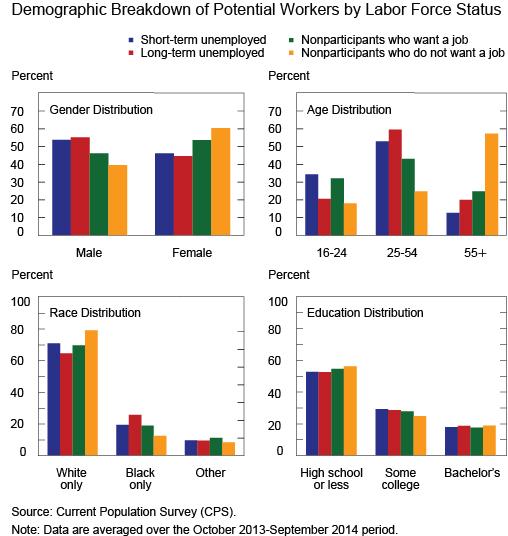

- Labor force participation: Current participation rates lag behind pre-pandemic levels, limiting available workers.

| Labor Market Indicator | Current Status | Desired Target |

|---|---|---|

| Unemployment Rate | 3.7% | 4.5% |

| Labor Force Participation | 62.4% | 63.5% |

| Year-over-Year Average Hourly Earnings Growth | 4.5% | 2.5% |

Navigating the Tradeoff Between Employment and Price Stability

Federal Reserve official Logan has highlighted that the labor market may still need to loosen to firmly anchor inflation expectations at the Fed’s 2% goal. Despite strong employment figures, ongoing inflation suggests the economy is operating beyond its sustainable limits. Logan advocates for a prudent approach, warning that maintaining an overly tight labor market could intensify inflationary pressures, potentially requiring more aggressive monetary tightening down the line.

Key takeaways from Logan’s analysis include:

- Accepting higher unemployment: A modest rise in unemployment could help slow wage growth and ease core inflation.

- Flexible monetary policy: Balancing the dual mandate of maximum employment and price stability remains critical.

- Data-dependent strategy: Future interest rate moves will be closely guided by labor market and inflation trends.

| Indicator | Current Level | Fed’s Target Range |

|---|---|---|

| Unemployment Rate | 3.7% | 4.2% – 4.5% |

| Core Personal Consumption Expenditures (PCE) Inflation | 3.8% | 2.0% |

| Federal Funds Rate | 5.25% | Neutral Range: 2.5% – 3.0% |

Economic Consequences of Sustained Labor Market Relaxation

Allowing the labor market to ease over an extended period, as a strategy to reduce inflationary pressures, will inevitably influence the broader economic growth path. By tolerating higher unemployment or underemployment, the Federal Reserve signals a shift from aggressive rate hikes toward a more gradual tightening approach focused on long-term price stability. While this can help moderate wage-driven inflation, it may also dampen consumer spending and business investment due to reduced household income and confidence.

Nonetheless, this approach could foster some positive outcomes. A more adaptable labor market might encourage businesses to innovate and improve efficiency amid softer demand conditions. Potential impacts of prolonged labor market slack include:

- Slower but more sustainable economic growth that reduces overheating risks

- Better-anchored inflation expectations supporting price stability

- Moderated wage increases easing cost-push inflation pressures

- Resource shifts toward emerging industries and technological advancements

| Economic Factor | Short-Term Impact | Long-Term Outcome |

|---|---|---|

| Consumer Spending | Moderate reduction | Stabilization through adjusted expectations |

| Business Investment | Hesitancy amid uncertainty | Shift toward innovation and efficiency |

| Wage Growth | Slowed or flattened | Potential rebound aligned with productivity gains |

Strategic Policy Approaches to Inflation and Labor Market Adjustments

To successfully balance inflation control with employment objectives, policymakers should adopt a multifaceted strategy. Central banks may need to tolerate a temporary rise in labor market slack, accepting higher unemployment or slower wage growth as necessary trade-offs to stabilize prices without triggering a sharp economic downturn. Complementary government policies aimed at enhancing workforce adaptability—such as retraining programs and targeted support for displaced workers—can ease the transition and mitigate adverse effects.

- Gradual interest rate increases to avoid shocks to consumer spending and investment

- Expanded unemployment benefits paired with active labor market initiatives to prevent long-term joblessness

- Investment in upskilling and reskilling aligned with evolving industry needs

- Close monitoring of real wage trends to keep inflation expectations anchored

| Policy Instrument | Intended Outcome | Associated Risk |

|---|---|---|

| Monetary tightening | Lower inflationary pressures | Increased unemployment |

| Workforce training programs | Smoother labor market transitions | Delayed effectiveness |

| Income support measures | Preserved consumer demand | Fiscal budgetary strain |

Ultimately, a balanced and coordinated policy mix that integrates monetary restraint with proactive labor market interventions will be vital. This approach can help the U.S. maintain economic stability, reduce the risks of abrupt inflation corrections, and foster a resilient and adaptable workforce.

Summary and Outlook

As the Federal Reserve continues to grapple with the challenge of balancing robust employment with inflation control, insights from officials like Logan emphasize the complexity of the path ahead. The suggestion that the labor market may require additional slack signals the Fed’s commitment to its 2% inflation target, even if it means adopting a more cautious and gradual approach to monetary tightening. Market participants will be closely watching upcoming economic indicators and Fed communications to better understand the evolving policy trajectory amid an uncertain economic environment.