Q2 2024 Sees Oil and Gas Activity Slowdown Driven by Elevated U.S. Steel Tariffs

The latest findings from the Dallas Federal Reserve reveal a contraction in the U.S. oil and gas sector during the second quarter of 2024, primarily influenced by the surge in tariffs on imported steel. Energy companies are facing heightened expenses and supply chain bottlenecks, which have curtailed drilling operations and exploration initiatives. This downturn interrupts a period of vigorous industry growth, highlighting the significant repercussions of evolving trade policies on energy production and infrastructure development.

Rising steel prices and procurement delays have emerged as critical obstacles, forcing operators to reconsider capital investments and project timelines. The following data illustrates the shifts in key operational metrics between the first and second quarters:

| Indicator | Q1 2024 | Q2 2024 | Percentage Change |

|---|---|---|---|

| Cost of Steel per Ton | $700 | $895 | +27.9% |

| Average Project Delay | 30 days | 45 days | +50% |

| Capital Spending | $2.5 billion | $2.1 billion | -16% |

- Escalating steel costs restricting upgrades to drilling rigs and pipeline infrastructure

- Procurement slowdowns causing cascading delays in project execution

- Conservative investment strategies reflecting industry caution amid uncertainty

Tariff Increases Disrupt Energy Sector Operations, Dallas Fed Survey Shows

The Dallas Fed’s recent survey highlights a significant pullback in drilling and exploration activities within the oil and gas industry during Q2 2024, directly linked to the hike in U.S. steel import tariffs. The increased costs for steel and related materials have led to postponed projects and a reduction in capital deployment. Industry executives emphasize that supply chain interruptions and rising operational expenses are undermining production efficiency and dampening business confidence.

Notable effects identified in the survey include:

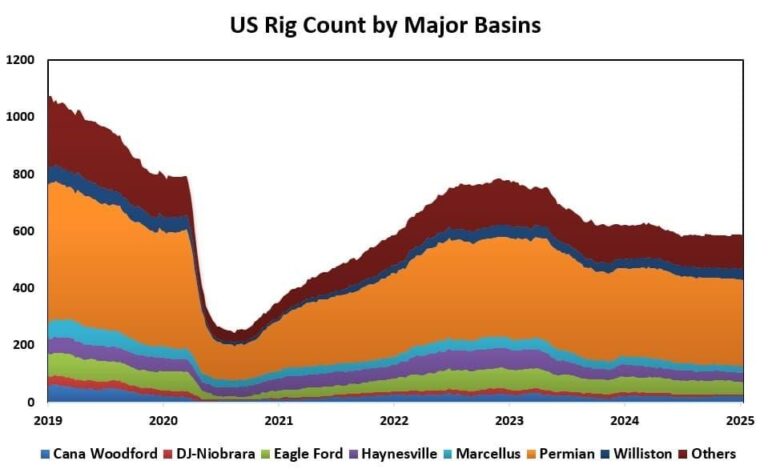

- Lower rig utilization rates across prominent shale formations

- Delays or cancellations of new infrastructure developments

- Longer lead times and higher costs for steel-based equipment procurement

| Metric | Q1 2024 | Q2 2024 | Change (%) |

|---|---|---|---|

| Drilling Activity Index | 78 | 62 | -20.5% |

| Steel Procurement Cost | $1,200/ton | $1,450/ton | +20.8% |

| Project Delay Duration | 2 weeks | 5 weeks | +150% |

Trade Policy Challenges Fuel Rising Costs and Project Delays in Energy Sector

The imposition of steeper steel tariffs by the U.S. government has introduced substantial operational challenges for oil and gas companies. These tariffs have inflated raw material prices, compelling firms to adjust budgets and timelines for ongoing and upcoming projects. Additionally, supply chain disruptions have extended lead times for critical equipment, intensifying financial pressures on producers and contractors.

Major consequences linked to these trade policy changes include:

- Capital expenditure increases driven by soaring steel prices

- Prolonged project schedules due to supplier delays and material shortages

- Declining investment confidence, leading some companies to halt or downscale expansion plans

| Area Affected | Impact |

|---|---|

| Material Expenses | Increased by 25% year-over-year |

| Project Timelines | Extended by 3 to 6 months on average |

| Operational Budgets | Raised by approximately 15% |

Strategic Approaches to Counteract Tariff Impacts in the Oil and Gas Industry

Industry experts and policymakers are calling for a reassessment of current tariff policies to ease the financial burden on oil and gas operations. Achieving a balance between supporting domestic steel producers and maintaining the competitiveness of energy companies is critical. Recommended strategies include:

- Introducing selective tariff exemptions for steel products essential to energy infrastructure projects

- Promoting cross-industry collaboration to develop innovative materials and streamline supply chains

- Fostering long-term strategic planning to better prepare for and mitigate future trade disruptions

These initiatives aim to shield the sector from tariff volatility while encouraging sustainable development. Proactive policy reform combined with forward-looking operational planning will be key to sustaining growth amid fluctuating trade environments.

| Proposed Action | Anticipated Benefit |

|---|---|

| Selective Tariff Exemptions | Lower input costs for energy producers |

| Cross-Sector Innovation | Enhanced material alternatives and operational efficiencies |

| Long-Term Strategic Planning | Greater resilience to trade policy fluctuations |

Looking Ahead: Navigating Uncertainty in the Energy Sector

The Dallas Fed’s recent survey clearly illustrates the tangible effects of increased U.S. steel tariffs on the oil and gas industry, with a marked slowdown in activity during Q2 2024. As companies contend with rising costs and supply chain challenges, the sector faces an uncertain future amid ongoing trade tensions. Stakeholders and analysts will be closely watching policy developments and market dynamics to gauge the broader economic consequences and identify pathways for resilience and growth.